Our Stock of the Week is TeraWulf, Inc. (WULF). WULF started as a bitcoin mining firm, but it has evolved into and is now offering High Powered Computing (HPC) services that are used for AI and other data-intensive activities.

TeraWulf is fully funded to execute its growth plans through 2025, and it is targeting about 250 MW of HPC by the end of 2025. Analysts are expecting one or two HPC deals to be secured by the end of 2024. The company had revenue of $27.1 million in the third quarter, which was an increase of 43% over 2023.

As a bitcoin miner, the stock is leveraged to the price of bitcoin, but the diversification into HPC provides a floor and will help the stock withstand downside volatility in bitcoin.

In the third quarter, Stanley Druckenmiller's Duquesne Family Office increased its holdings in WULF to 2.94M shares from 2.09M. Recent price targets are $9.50 from Needham, $10 from Northland, $11 from Roth, and $11 from Cantor.

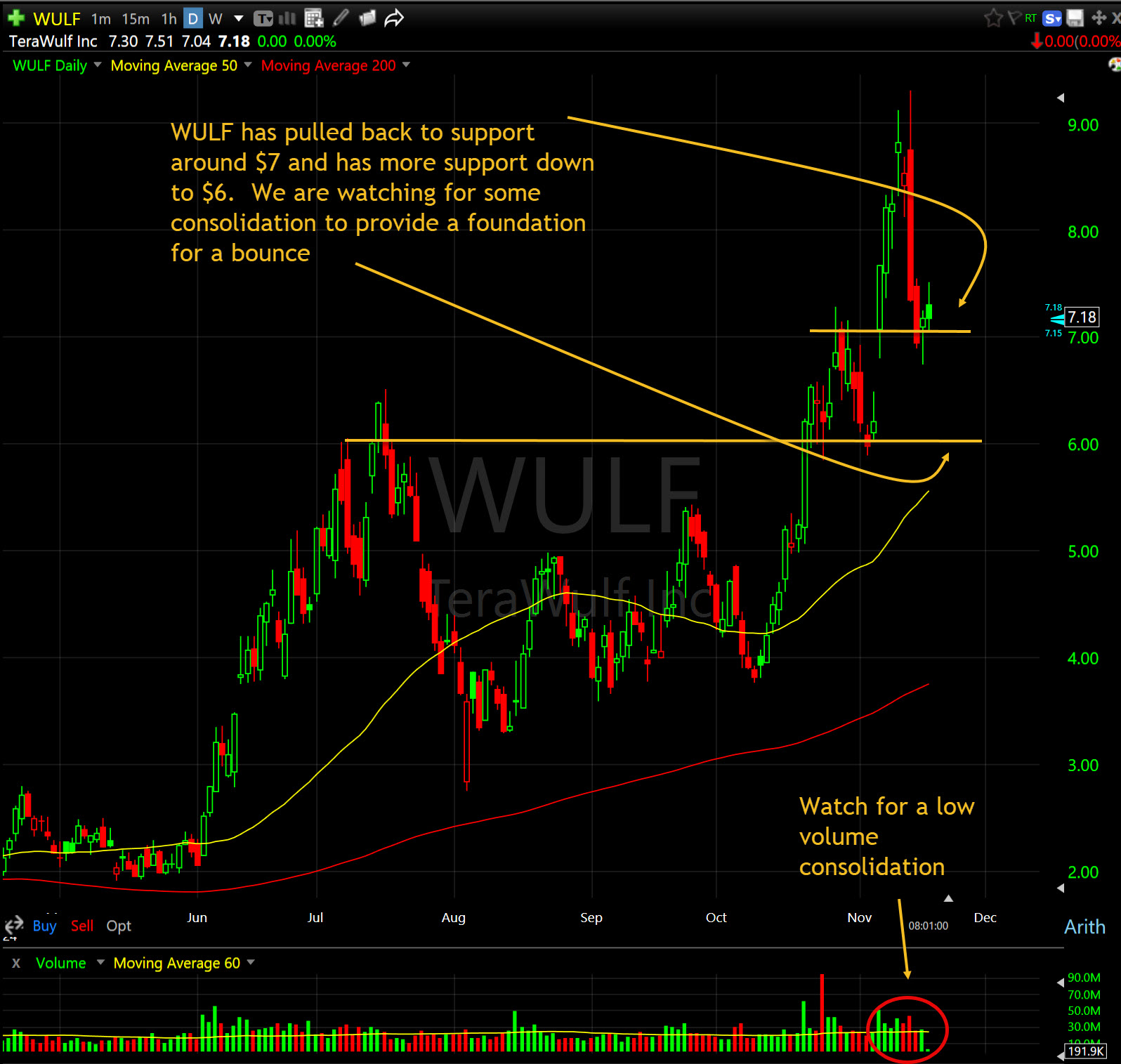

Technically, the stock pulled back last week and is testing support for the $7 area. There is still a small cap on the chart down to $6.50, but there is very significant support at $6. We are looking to buy pullbacks down to that support area. We are expecting HPC deal news to provide a positive catalyst. As always, we will not chase strength to start the week.

This post is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this post. Do not buy, sell, or trade the stocks mentioned herein. We WILL actively trade this stock differently than discussed herein. We will sell into strength and buy or sell anytime for any reason. We will actively trade into any unusual activity. At the time of this post, principals, employees, and affiliates of Shark Investing, Inc. and/or principals, clients, employees, and affiliates of Hammerhead Financial Strategies, LLC, directly or indirectly, controlled investment and/or trading accounts containing positions in WULF. To accommodate the objectives of these investing and/or trading accounts, the trading in these shares will be contrary to and/or inconsistent with the information contained in this posting.