Our Stock of the Week is Remitly Global (RELY). RELY is a digital finance and cross-border payments company specializing in money transfers from workers or citizens abroad to support their families back home. These remittances allow a growing number of immigrants in the global market to help families in their home countries. In 2022, there were $831 billion transferred in this manner.

RELY transfers money through ‘remittance corridors’ where funds flow from one territory to another. Transfers from the U.S. to Mexico comprise one corridor, and transfers from Mexico to the U.S. are a separate corridor. Remitly currently offers services in more than 170 countries and 4,800 corridors. In August, the company reported 5 million active customers, which is a 47% increase over the prior year year-over-year and more than double the 2.1 million customers from the first quarter of 2021.

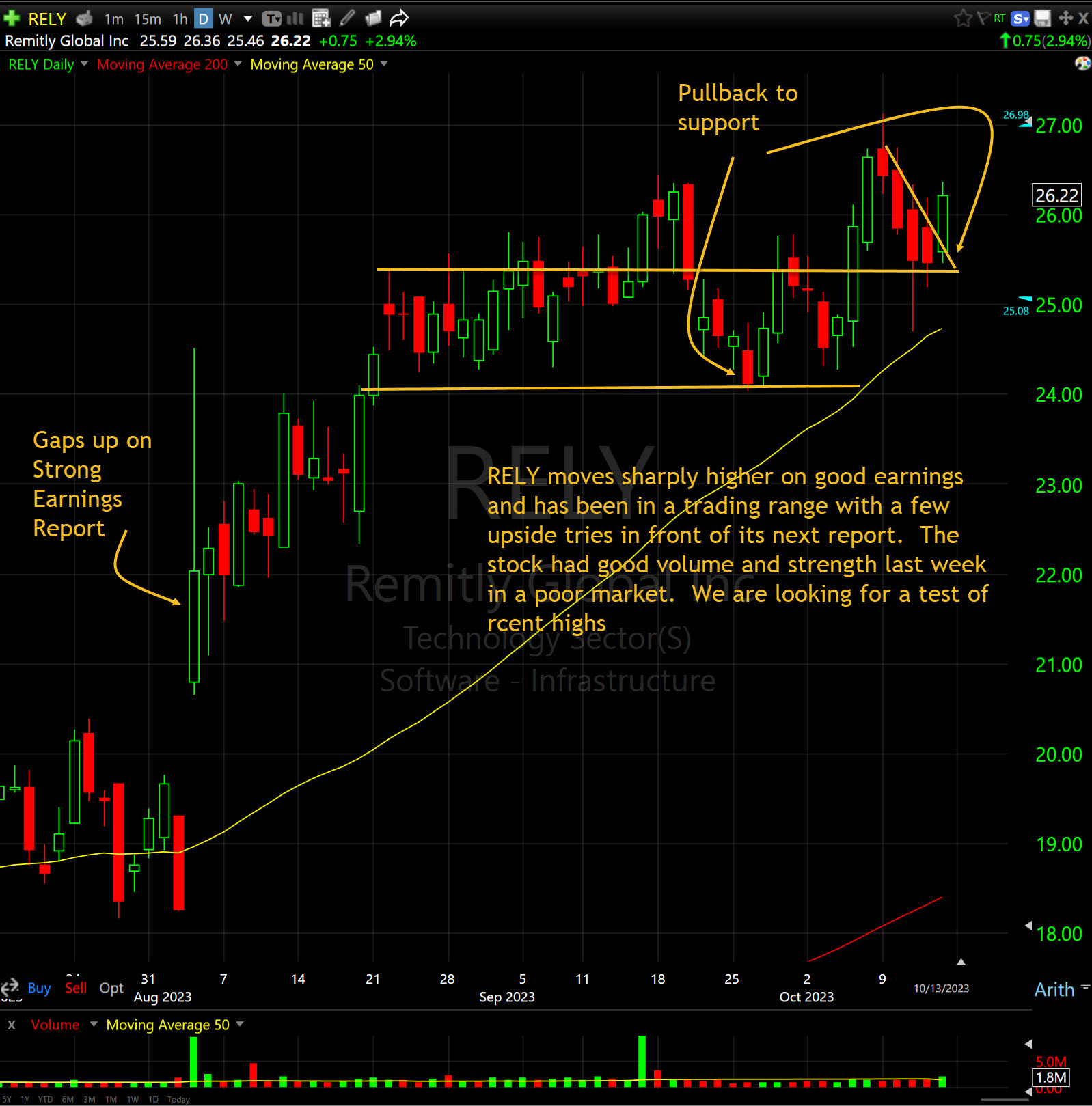

RELY’s revenue has averaged 45% revenue growth in the past four quarters, including a 49% increase to $234 million during its second quarter. The company projects 2023 revenue to increase 40% to 42% to range from $915 million to $925 million. It previously called for revenue between $875 million and $895 million. The company is expected to double its EPS to $0.39 in the calendar year 2024. RELY reported a loss of 11 cents per share for the second quarter, improving from a 23-cent deficit last year. The company has topped earnings estimates in the past three quarters and has beaten Wall Street sales predictions every reporting period quarter since the first quarter of 2022.

Last week, Goldman Sachs moved up its price target from $25 to $34. On September 18, JPMorgan Securities hoisted its price target on Remitly stock to 32 from 26.

Technically, the stock is attempting to break out of a trading range that has formed following the last earnings report. It performed very well on October 13 in a poor market with a solid gain on increased volume.

As always, we will not chase the stock on Monday but will aggressively trade our position as market conditions develop.

This post is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this post. Do not buy, sell, or trade the stocks mentioned herein. We WILL actively trade this stock differently than discussed herein. We will sell into strength and buy or sell anytime for any reason. We will actively trade into any unusual activity. At the time of this post, principals, employees, and affiliates of Shark Investing, Inc. and/or principals, clients, employees, and affiliates of Hammerhead Financial Strategies, LLC, directly or indirectly, controlled investment and/or trading accounts containing positions in RELY. To accommodate the objectives of these investing and/or trading accounts, the trading in these shares will be contrary to and/or inconsistent with the information contained in this posting.