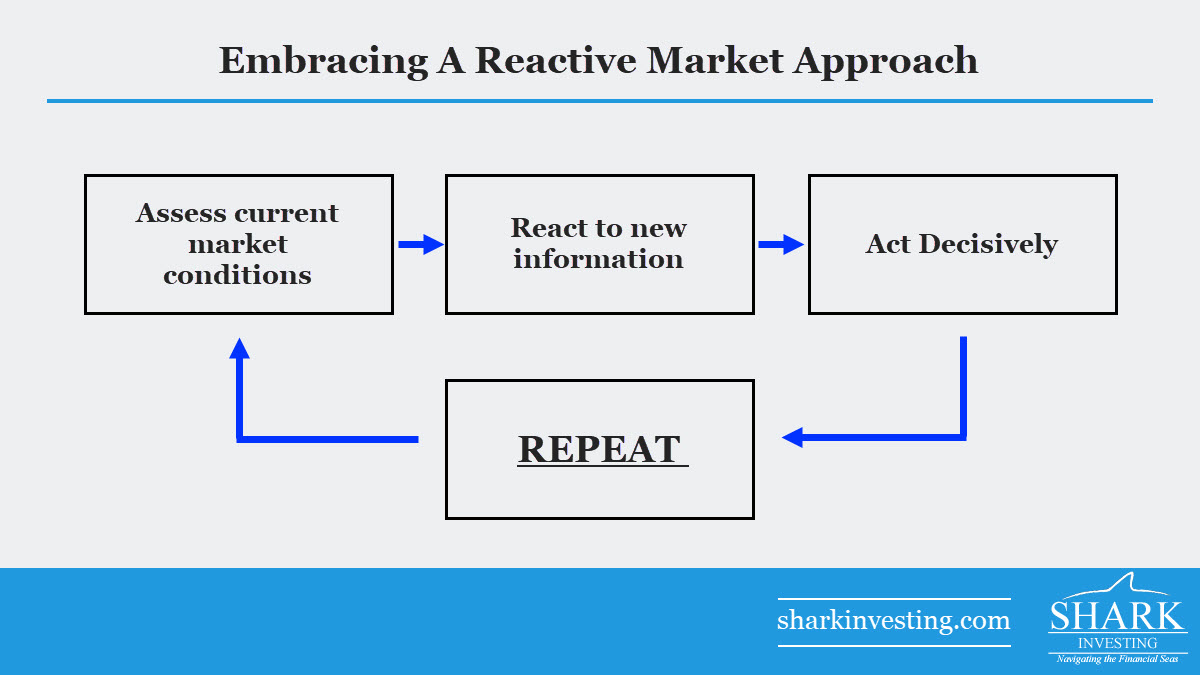

If there’s one change that the majority of individual investors could make that would vastly improve their effectiveness when it comes to navigating the market, it would be to focus more on reacting to price action in a decisive manner rather than trying to predict what the market will do next.

Embracing this approach has been key to my evolution as a trader. Gaining an appreciation for not only the difficulty making any sort of prediction but also getting both the timing right and the subsequent market reaction was liberating, which offered me the freedom to focus instead on reacting to new information quickly and decisively.

Since the lows of 2009, I suspect more money has been lost on the market by folks trying to guess a market top than any other approach. And, notably, since early 2021, one fund, in particular, has brutally encountered the challenge of trying to predict which emerging growth stocks will become the next crop of market leaders.

Yet, it would seem that timing exact market tops and bottoms and being in on the ground floor of the next APPL or AMZN should be the overarching goal of every astute trader or investor.

Conventional Wall Street and the whole of the financial media machine want investors to believe that they should stay “ahead of the crowd”… and (of course) they’re the ones to help us do that! Being “early” certainly seems to be a reasonable way to ensure success, but unfortunately, doing so has almost everything to do with luck and very (very) little to do with skill. Indeed, the idea that market events can be predicted or anticipated with enough precision to be actionable and produce good returns in a reasonable time frame is a tall order, to say the least.

Accordingly, the first step toward improving your methodology is accepting the simple fact that there’s no way you can accurately predict what the future holds across any time frame. No one else has ever been able to do it, and it’s freeing to accept that you can’t either. In fact, the folks who have made successful “big calls” have only done so after repeatedly making that same call over and over again until it eventually came true.

Next, moving past the prediction game allows you to stop worrying about all the proverbial tea leaves that pundits say are important and concentrate all of your mental efforts on the only thing that truly matters, which is price action.

The ultimate arbiter of your results isn’t whether or not you’re right about what the next piece of economic data may be or what any company’s next earnings report might be… it’s the price action. Everything else is either secondary or meaningless. All the astute analysis in the world doesn’t mean a thing if the pricing action doesn’t follow. Moreover, using the pricing action as your primary guide makes timing irrelevant. You don’t have to guess when the market will shift. The price action will tell you when a shift occurs.

The biggest caveat, however, is that “pricing action” is a fluid concept and it can give a conflicting message at times. For instance, through the final three quarters of 2021, the vast majority of individual stocks had entered a ruthless bear market, but because the indices were hitting record highs, that terrible pricing action was largely ignored. Price action is not a monolithic concept although when a major market shift does occur it tends to be correlated across most of the market.

As such, effectively reacting to the price action requires us to focus intently on the individual names in our portfolios. Don’t try to guess what might happen next week. Focus on what is happening right now. Is the character of the action shifting? Is this just normal volatility? What is the best way to protect my profits or add to my position? Is the trend still strong or is it extended? Don’t let any preconceived notions about a company’s prospects or “story” prevent you from taking action if a stock starts to break key support levels.

Deal with hard facts and not predictions about what might happen. Wall Street wants to convince you of its value, and they’ll do so by telling us that they have better insight than anyone else. Ignore them, and instead, focus on the plain information that is right in front of you.